There are only 5 months left until the deadline for applying the International Financial Reporting Standards (IFRS) mandatory for all enterprises in Vietnam, starting from 2025. To apply IFRS, enterprises must prepare highly specialized human resources, understand the new system of standards and be able to apply them to the actual operations of each unit.

With the conversion of financial statements from VAS to IFRS, enterprises will have many changes in processes, procedures and software, leading to costly costs and time… whether enterprises have prepared human resources, knowledge and solutions for applying this standard.

Conversion to IFRS financial statements, an “unchangeable” trend

Financial statements play an important role in monitoring and evaluating the financial situation and performance of enterprises, serving the needs of internal management and attracting investment. International financial reporting standards IFRS set strict requirements for financial reporting and control, based on the principle of strict accounting assumptions, ensuring honesty and accurately reflecting the financial situation of enterprises.

The conversion to IFRS in Vietnam is being promoted, especially with the encouragement from the state for large enterprises and enterprises with foreign investment capital. Although still in the voluntary stage, many enterprises have recognized the importance of IFRS and are actively implementing it.

The purpose of this report is to examine the use of resources, cash flow, business performance and current financial status of the enterprise. Thereby, leaders and investors can make the right decisions in corporate governance.

IFRS international standard financial statements also open up opportunities to access international capital markets. A specific example is that to be listed on foreign exchanges, the minimum requirement is that enterprises must have financial statements prepared and presented according to widely accepted international standards such as IFRS.

Applying international financial reporting standards (IFRS) is an inevitable trend for enterprises, especially large-scale Vietnamese enterprises in the context of increasingly deep international economic integration.

In addition, IFRS standard financial statements demonstrate transparency and honesty, helping to increase trust and reduce risks for investors and lending institutions, contributing to establishing an effective monitoring tool system to meet the economic management requirements of state agencies, promoting development and global economic integration.

IFRS, with more than 40 detailed standards covering all aspects of business operations from fixed assets to revenue, has become a common language for global financial reporting. This unification not only helps investors and partners easily compare and evaluate the financial situation of enterprises but also eliminates information barriers between countries. With widespread acceptance from 166 countries, IFRS has proven its irreplaceable position in the context of today’s integrated economy. The fact that companies listed on international stock markets are required to apply IFRS further confirms this inevitable trend.

“Water is at the feet” – Enterprises need to complete resources and technological solutions to be ready for the conversion of IFRS financial statements

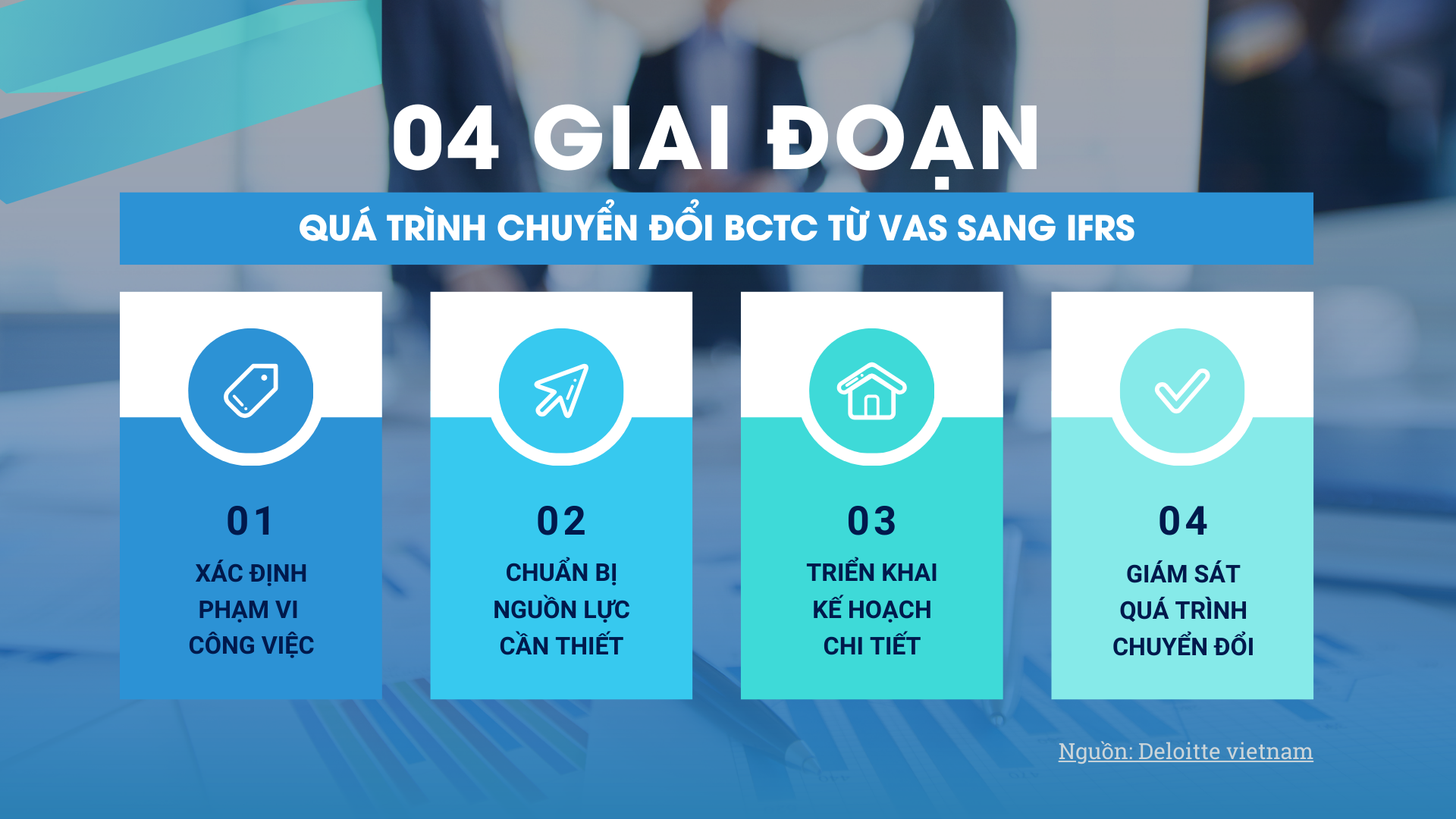

In the publication on converting VAS standards to IFRS issued by Deloitte Vietnam, to complete the IFRS conversion, enterprises need to go through 4 stages: Determining the scope of work, preparing necessary resources, implementing the plan and monitoring the conversion process.

At present, most businesses have been and are implementing steps to prepare for this conversion process. Focusing resources is a key factor, including both human resources and technological solutions. Regarding human resources, in addition to training a team of accounting and financial staff specializing in IFRS, businesses need participation and direction from the board of directors as well as close coordination from related departments.

In addition to human resources, businesses have also proactively sought and applied technological solutions. Applying accounting software that can connect data, books and automatically convert data according to IFRS standards is extremely necessary.

These are two important aspects as well as taking the most time in the 04 stages of the process of converting financial statements from VAS to IFRS. However, the sooner a business is ready with resources and technology solutions, the more time-saving and cost-optimized the detailed implementation and monitoring of the conversion process will be, ensuring that the business’s conversion of financial statements to IFRS takes place smoothly and effectively after 2025.

FPT CFS: Solution to increase efficiency for IFRS standard financial statement consolidation after 2025

Data and reports according to VAS standards are not fully compatible with IFRS due to differences in accounting principles, methods of recording and presenting information in financial statements. To solve this problem, enterprises can use IFRS conversion support tools to help automate the adjustment of VAS data, ensuring compliance with current accounting standards (including VAS and IFRS).

FPT CFS comprehensive financial statement consolidation solution allows the integration of data from many different sources, ensuring accuracy for financial statement implementation according to VAS standards, declaring and managing related information, evaluating and recording differences according to IFRS standards.

In addition, FPT CFS helps businesses simplify accounting processes, increase the ability to automate the preparation and consolidation of financial statements by up to 99%. Report preparation time is reduced by up to 80% and accordingly, the issuance of separate and consolidated reports of businesses is improved by 60% faster than the previous average time.

With FPT’s technological capabilities, the solution provides data and reports in real-time, helping business leaders monitor, control and have a thorough view of the “health” of the business’s finances. From there, making better financial management decisions, freeing up specialized resources to focus on strategic financial tasks or those that have a great impact on the business.

The core of the FPT CFS system is a relational database design, multi-dimensionally partitioned and flexibly configurable to meet the needs of large data processing. Adapted to the configuration of the unified processing business, the system provides data models that can be configured by the end user. Accordingly, all reporting data is processed and calculated in real time, with high accuracy and impressive response speed.

Currently, a number of large enterprises in Vietnam have applied FPT CFS technology solutions for comprehensive financial statement consolidation, such as Hai An Group, Medlatec, Kim Tin, Dat Xanh… The solution is suitable for enterprises with many levels or member units with the ability to customize according to the specific model of the enterprise, contributing to improving financial management and optimizing performance.

Read more: 4 factors to help the financial reporting conversion process between VAS and IFRS succeed