In the context of increasingly expanding corporations, the accounting-finance department must frequently conduct thousands of internal transactions among member companies. This task requires the elimination of internal transactions and debts to present an objective and reasonable consolidated financial statement. This is a factor that creates complexity in consolidating financial statements (CFS), which has become one of the most important tasks of the accounting department.

This reconciliation may seem simple in theory; however, when delving into the processes of reconciling internal transactions and receivables and payables, accountants face numerous difficulties and challenges, leading many companies to become confused, and even face the risk of financial data discrepancies.

Intercompany transactions and accounts reconciliation: more complex than it appears

Intercompany transactions are inevitable for diversified corporations. These include transactions related to goods, services, or assets occurring among subsidiaries. In theory, reconciliation to eliminate these transactions and ensure the objectivity of financial statements may seem simple. However, companies often face complex challenges.

Discrepancies in invoice recognition are a typical example. Differences in recording methods among subsidiaries, ranging from invoice errors, missing tax codes, to incorrect transaction amounts, are key causes of data discrepancies. These errors often force accountants to spend significant time reviewing and adjusting data, impacting the reporting timeline.

Subsidiaries operating in multiple countries often adhere to different accounting standards and legal regulations, resulting in data inconsistencies. With thousands of intercompany transactions generated daily, large corporations are compelled to manage an overwhelming volume of data. Relying on manual reconciliation processes not only consumes significant resources but also increases the risk of errors.

Specifically, the end of the accounting period is a critical and high-pressure time for the accounting team. When intercompany transactions are not processed promptly, backlogs occur, leading to a heightened risk of mistakes. This not only delays the reporting process but also impacts financial transparency – an essential factor in building trust with shareholders and partners.

Difficulties in identifying and collecting intercompany transactions and balances with related parties pose significant challenges for large corporations due to the complex relationships among entities. These challenges can easily result in errors, prolong reporting timelines, and negatively affect financial management efficiency. So, what solutions can optimize this process?

Applying technology to optimize the process

To address these challenges, businesses need to adopt advanced technology solutions to automate and enhance the efficiency of intercompany transaction reconciliation processes.

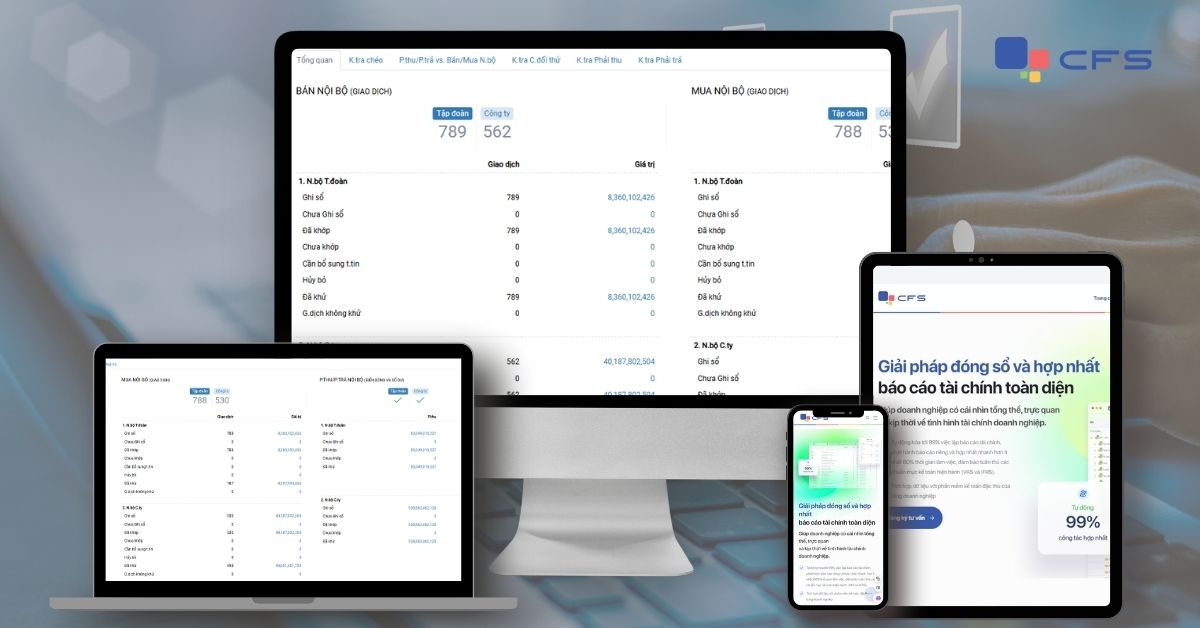

Financial management systems such as the most comprehensive financial reporting solution – FPT CFS have the capability to automate transaction reconciliation, significantly reducing manual workloads. One of the standout features of this solution is its ability to automatically reconcile 100% of internal transactions among member companies, helping to eliminate internal transactions and liabilities, ensuring data uniformity and eliminating errors or duplication in consolidated financial statements.

Moreover, synchronizing data across subsidiaries via a centralized system enhances consistency. This system ensures continuous data updates, minimizes errors, and improves traceability. Additionally, it reduces end-of-period workloads, saving time and boosting reporting accuracy.

Furthermore, for accounting teams, training in big data processing skills and the use of modern tools significantly contributes to ensuring accuracy and efficiency in their work. Enhancing awareness of international accounting standards is also a crucial aspect of optimizing processes.

The reconciliation of intercompany transactions and accounts receivable/payable remains one of the most significant challenges for large corporations when preparing consolidated financial statements. However, with the rapid advancement of technology, solutions such as the FPT CFS system have proven their critical role in streamlining this process. For financial managers and chief accountants, investing in modern financial management systems not only ensures operational efficiency but also strengthens the trust of investors and stakeholders.

Companies that effectively leverage technology to tackle this challenging issue will gain a competitive edge, thereby achieving long-term financial and strategic objectives.