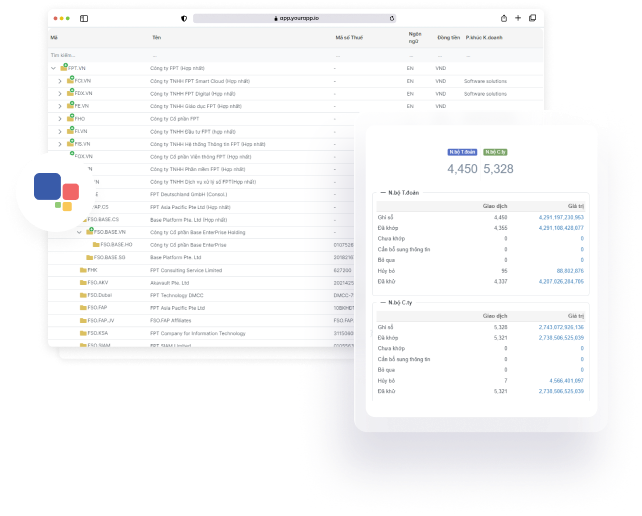

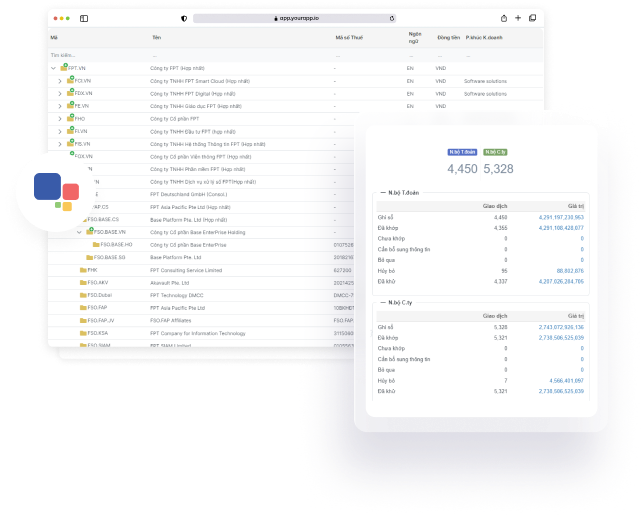

The most comprehensive financial reporting solution

Standardize and automate consolidated financial

statement preparation per accounting standards.

x

%

%

Financial Statement Consolidation Process – FPT CFS

The solution enables enterprises to standardize and automate 99% of the consolidated financial statement preparation process, ensuring high accuracy and stability, with easy data retrieval and export capabilities.

1. Open Period

2. Carry Forward Balances

3. Declare Exchange Rates

4. Update Consolidation Scope

5. Supplemental Declaration

1. Data Aggregation

2. Automated Calculations

3. Intercompany Transactions

4. Currency Adjustments

5. Verification

1. Report Conversion

2. Variance Adjustments

3. Adj Journal Entries

4. Unrealized Profits Confirmation

5. Verification

1. Goodwill Allocation

2. Goodwill Adjustments

3. Eliminate Intercompany Transactions

4. Equity Investments Consolidation

5. Journal Entries

6. Intercompany Profits Recognition

7. Necessary Calculations

8. Verification

1. Balance Sheet

2. P&L Statement

3. Cash Flow

4. Notes

5. Supplemental Information

6. Final Cross-check

7. Close Period

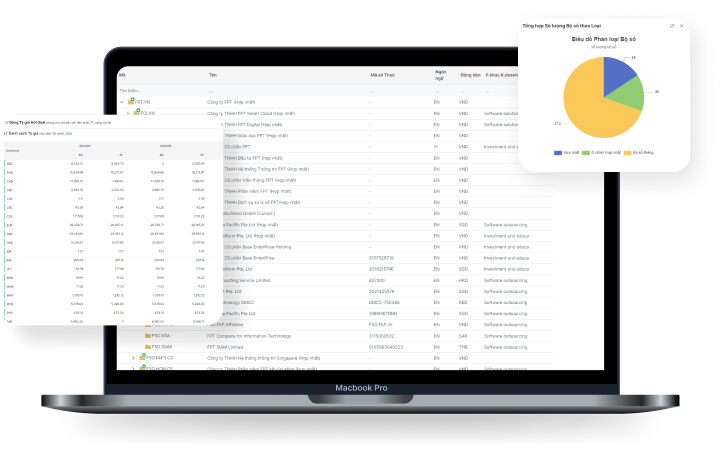

New Modules of FPT CFS Solution

New modules will be added to enhance the efficiency of financial statement consolidation for enterprises.

Corporate Tax Management

Automates the calculation process for corporate income tax, value-added tax, and other types of taxes, minimizing errors and saving time. Continuously updates changes in tax regulations to ensure compliance. Supports the preparation of tax reports quickly, accurately, and comprehensively as required by tax authorities.

Mergers and Acquisitions

Supports the Mergers and Acquisitions (M&A) process from planning to transaction completion, including business valuation, negotiation, contract signing, financial statement consolidation, etc. Provides specialized tools and in-depth reports to enable enterprises to make informed decisions in M&A activities.

Liquidity Risk Management

Provides tools for cash flow forecasting, financial planning, and fundraising to ensure sufficient liquidity for settling due obligations. Assists enterprises in identifying, evaluating, and managing liquidity risks effectively, enabling timely financial decisions to mitigate risks and improve liquidity.